The Liberal government’s latest plan to get more rental housing built is to expand a program that helps developers secure cheaper mortgage rates as higher interest costs affect the viability of new projects.

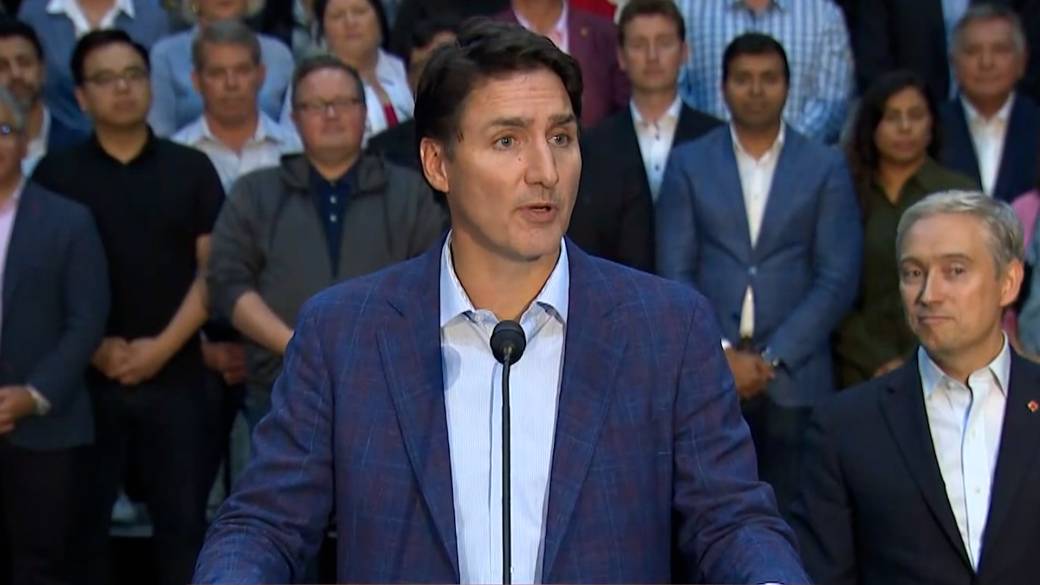

Finance Minister Chrystia Freeland announced Tuesday that the federal government is expanding the annual limit for the Canada Mortgage Bonds program to $60 billion from $40 billion previously.

Builders who access the Canada Mortgage Bonds program have their loans secured by the federal government. That lowers the risk for lenders, who are able to offer interest rates on financing that are typically one to two percentage points lower than market mortgage rates, according to Freeland.

Expanding the availability of cheap financing in the market would add an estimated 30,000 rental units to Canada’s housing stock annually, according to Ottawa’s projections.

Purpose-built rental projects with five or more units will qualify for the bonds. Freeland said the expansion will take effect immediately and have “no fiscal impact” on the government’s books.

“We’re just adding some juice to a program that already exists,” she told reporters on Tuesday.

“We don’t have to invent new things. We simply will have more financing available for a program which we know already works and is already playing an essential, even fundamental role in the multi-unit rental construction market.”

There are no quotas for affordable or otherwise below-market rental units to be included in the proposed projects for builders to access the bonds.

The expansion of Canada Mortgage Bonds comes after the Liberal government announced plans to scrap the GST on new rental apartments as a way to incentivize more builders to break ground on projects that might not have been financially viable otherwise as the costs of construction rise.

Developers have been beset with higher costs for land and materials in recent months, Housing Minister Sean Fraser noted at Tuesday’s announcement. Those increased expenses, alongside rising interest rates from the Bank of Canada, have led builders to pause some already approved projects until financing is secured, he said.

Moves like the GST rebate and the expansion of the Canada Mortgage Bonds program are an effort by the government to cut the cost of construction and incentivize builders to move ahead, Fraser said. On multi-unit projects valued at more than $100 million, the interest savings of one to two percentage points over the lifetime of the project can save builders “millions,” he said.

“We’re seeking to change the financial equation for homebuilders, to influence them to say yes to projects that have been put on the shelf as a result of the more expensive landscape that they’re operating in now,” Fraser said.

Freeland pointed to an announcement from Toronto-based Dream Unlimited Corp. on Monday that it would move forward on building 5,000 rental units across Canada thanks to the GST rebate as proof the Liberals’ housing strategy was making an impact in filling the housing gap.

The Canada Mortgage and Housing Corp. earlier this month reiterated its projection that the country will fall short of the 3.5 million additional housing units needed to restore affordability in the market by 2030.

The proposed GST rebate is part of the Liberals’ Bill C-56, which was formally introduced last week and is currently up for debate in the House of Commons.

© OfficialAffairs