DETROIT — Ready for a tightrope walk?

General Motors and Ford Motor report third-quarter earnings and future guidance this week amid ongoing strikes and contract negotiations with the United Auto Workers union. And it’s a difficult balance.

If the automakers are bullish and exceed Wall Street’s expectations, it could fuel the union’s main argument that the companies can afford more concessions amid healthy profits — potentially prolonging the work stoppages and contentious talks.

But if the companies, which will likely include many caveats in any future comments, are too bearish on guidance or the impact of UAW efforts, they risk scaring Wall Street and denting their already discounted stock prices.

GM is expected to report third-quarter earnings of $1.88 per share before the bell Tuesday, while Ford is estimated to report earnings of 45 cents per share after markets close Thursday, according to average estimates compiled by LSEG, formerly known as Refinitiv.

While investors will surely note the third-quarter results, the real watcher is expected to be the effects of the UAW strike and negotiations on near-term earnings and longer-term plans of Ford and GM, as well as automaker Stellantis, which the union is also striking.

The union will be watching, too.

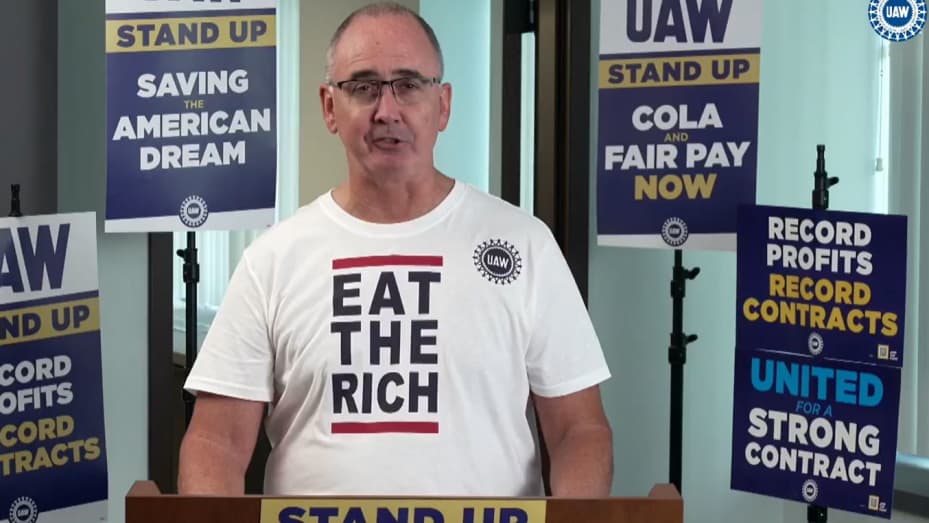

The UAW has consistently used earnings reports and commentary from executives, including GM CEO Mary Barra and Ford CEO Jim Farley, to promote its efforts and collective bargaining.

“When you’re in bargaining you want to use every piece of news that’s in your favor and bring it up and bring it to the public and to the table,” said Art Wheaton, a labor professor at the Worker Institute at Cornell University. “If GM, Ford and Stellantis are still very profitable for the third quarter, [UAW’s] going to claim that, ‘They’re being too cheap in bargaining, and they should give us more.’”

The union on Friday said there was “more to be won” despite record contracts from the automakers. It declined, however, to expand work stoppages.

Still, its targeted strikes against the three major automakers, which started Sept. 15, are expected to have more impact during the fourth quarter than the prior three months. The UAW has slowly been expanding the work stoppages to include additional assembly plants and distribution centers.

GM has said the work stoppage cost it roughly $200 million in lost production in September. Ford and Stellantis, which reports its quarterly results on Oct. 31, have not disclosed their estimates of the impact of the strikes.

JPMorgan estimates strike costs amounted to $145 million at Ford and $191 million at GM in terms of earnings before interest and taxes during the third quarter.

Those losses are expected to have ballooned in the fourth quarter to $517 million for Ford — after the union initiated a work stoppage at its most profitable U.S. truck plant in Kentucky — and $507 million for GM.

The Kentucky plant — responsible for $25 billion in revenue annually — was by far the most crucial strike initiated by the union. It produces F-Series Super Duty pickup trucks as well as Ford Expedition and Lincoln Navigator SUVs.

While many analysts continue to view the UAW strike as a short-term problem, some are acknowledging that the hefty costs of an eventual concessionary deal could affect automakers’ electric vehicle plans and long-term competitiveness compared with other, non-union, automakers.

Wolfe Research analyst Rod Lache said Monday that labor costs for the Detroit automakers, based on recent proposals, are expected to increase to $3,000 to $4,000 per vehicle, compared with competitors’ costs of $2,500 to $3,000.

“This could compound other challenges that the OEMs [original equipment manufacturers] face (e.g. competitiveness in batteries, distribution, design). And we also worry that the OEMs may still not fully appreciate the long-term risks associated with UAW’s new tack — including bargaining in public, social media, and populism,” Lache said in an investor note. “The Automakers appear to be struggling to adjust to this reality.”

The most recent offers from GM and Ford have included 23% wage increases over the life of the deal, reinstatement of cost-of-living adjustments, additional vacation days and other enhancements compared with the 2019 contracts.

The negotiations have also had an impact on electric vehicles, which were already selling more slowly than expected amid inflation, high interest rates and lack of infrastructure.

Ford last month said it was pausing construction of a new $3.5 billion battery plant in Michigan until the company is “confident” in its ability to competitively run the plant amid the UAW talks.

And GM this week said it would delay production of all-electric trucks at a Michigan plant by at least a year to “better manage capital investments” and implement improvements in an effort to make the new EVs more profitable.

A GM spokesman said the change in plans was not connected to the company’s contract negotiations with the UAW. However, the contentious talks do involve EVs, and current contract proposals by the company are expected to be more expensive than those in years past.

Wall Street will be watching for updates on EV progress and demand.

Even Tesla CEO Elon Musk, whose company leads EV sales, was cautious regarding demand for electric vehicles when Tesla reported earnings last week.

“I’m worried about the high interest rate environment we’re in,” Musk said. “If interest rates remain high or if they go even higher, it’s that much harder for people to buy the car.”

© OfficialAffairs