The UK manufacturing industry continued its contraction in October, with difficult and uncertain market conditions leading to output, new orders and employment all declining, according to the latest S&P Global / CIPS UK Manufacturing PMI®.

October 2023 UK Manufacturing PMI key findings:

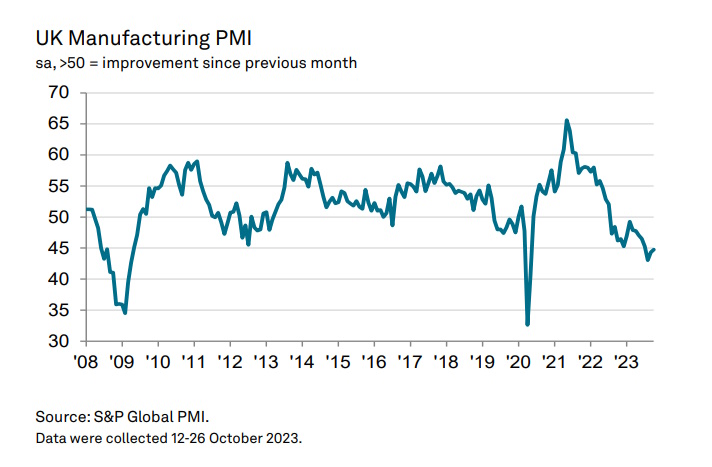

In October, the seasonally adjusted UK Manufacturing PMI rose slightly to 44.8, up on September’s reading of 44.3 but below the earlier flash estimate of 45.2. A reading below 50 suggests contraction in the sector and we have now been in this territory for 15 months.

All five PMI sub-components dipped in October. Alongside contractions in new orders, output and employment, stocks of purchases also declined. Meanwhile, suppliers’ delivery times improved, another traditional sign that demand is weak.

The fact October saw production levels fall for the eighth successive month now means we are in the most sustained sequence of unbroken contraction since

2008/09. Furthermore, the rate of decline remained solid and was slightly sharper than in the previous PMI survey month.

Weaker inflows of new work from Europe, mainland China and Brazil were the main factors behind a twenty-first successive month-on-month decline in new export business.

Manufacturing job losses continued for the thirteenth consecutive month, with spare capacity contributing to the latest round of job cuts and a reduction in work backlogs.

Despite retaining their overall positive outlook, manufacturers’ optimism faltered to a 10-month low in October. While 54% said they expect to see output rise over the coming year, 36% forecast broad stagnation. The remaining 10% said they anticipate further contractions.

Commenting on the latest survey results, Rob Dobson, Director at S&P Global Market Intelligence, said: “The UK manufacturing downturn continued at the start of the final quarter of the year, meaning the factory sector remains a weight dragging on an economy already skirting with recession.

“Production volumes contracted for the eighth consecutive month, the longest sequence of continual decline since 2008-09, as weak demand at home and overseas led to a further retrenchment of new order intakes. Companies are finding trading conditions difficult as they face headwinds from client destocking, market uncertainty and the impact of the cost-of-living crisis on consumer demand.

“Risks to the outlook remain skewed to the downside. Business optimism dipped to a ten-month low and manufacturers’ increased belt-tightening drove cuts to employment, purchasing and inventories.

“Although both input prices and output charges fell in October, this brighter inflation outlook comes at the cost of increased recession risk, being a symptom of the broader weak demand malaise.”

Dr. John Glen, Chief Economist at the Chartered Institute of Procurement & Supply, said: “With another contraction in manufacturing activity, any sustained optimism about the next 12 months amongst manufacturing companies was likely to be as a result of hope over the evidence.

“That’s because the UK economy remains in poor shape, and subsequently manufacturing production is experiencing its most sustained downturn since the recession of 2008/9. New order placements at manufacturing businesses dropped for the seventh month in a row, as demand from both domestic and overseas customers declined. Job losses continued as cuts in operational capacity seemed to be the only way for firms struggling to pay bills to keep their heads above water.

“An improvement in input costs, which fell for the sixth month in a row, and improved delivery times was not enough to boost the sector back into growth.”

Dave Atkinson, SME & Mid Corporates head of manufacturing at Lloyds Bank, said: “The latest data shows manufacturers continue to have concerns about the economy, even though we have seen some easing of the challenges from rising interest rates and supply chain disruption.

“However, as one of the most resilient and agile sectors, manufacturing businesses that are prepared to continue to invest in technology can drive growth opportunities, by improving productivity, reducing energy costs, mitigating gaps in their supply chain or boosting their sustainability.”

Maddie Walker, Industry X lead for Accenture in the UK, said: “In a persistently challenging environment, it is unsurprising that the manufacturing industry remains in negative territory for yet another month – with every marker measured by the Index, from new orders to output, indicating further decline.

“Leaders are acutely aware of the challenges and the potential of recession, so are understandably cautious. However, with that in mind, now is the time to strengthen their position where possible. This includes ensuring that digital technologies are being implemented to support business objectives, whether this be to streamline supply chains or to boost automation.

“Businesses will be closely watching the Chancellor’s upcoming Autumn Statement to see what plans are set out to support this sector into next year, with hopes of a much-needed confidence boost for the sector amid a stubbornly challenging environment.”

Caroline Litchfield, partner and Head of Manufacturing and Supply Chain sector at Brabners, said: “Manufacturing’s long-running downturn continues as weak demand further limits output and job creation across the sector.

“In the regions, in particular, the longer-term optimism of some leaders is likely to have been curtailed somewhat by the cancellation of HS2’s northern leg. The project was set to free-up crucial rail freight capacity between Northern and Midlands manufacturing heartlands – boosting productivity while enabling firms to lower supply chain emissions.

“However, HS2’s revision does create an opportunity for central government and the private sector to regroup and align on a new industrial strategy that effectively nurtures innovative manufacturing clusters in the regions.

“Automotive is likely to be a key priority in that respect, with the Government continuing to support investment in EV battery supply chain technologies – most recently with £9m of new funding for Aston Martin. Such action may help to settle nerves among subsector leaders following the surprise of September’s internal combustion engine (ICE) ban delay to 2035.”

Boudewjin Driedonks, Partner and B2B Pricing Leader, at McKinsey & Co, said: “The flash had created some signs of hope and while there will be some relief that UK figures have not fallen again like in Europe, the decline still shows signs of holding steady.

“Activity remains subdued but we are now seeing consecutive months of gradual recovery. This is welcome news to any UK manufacturers who were alarmed by the latest HCOB Eurozone Composite PMI dropping to a 35-month low.

“Even so, 2023 is likely to become a year with no month-on-month growth. The double whammy of soft demand and elevated inflation – albeit finally slowing now – is increasing the pressure on UK manufacturers. Many are closely watching whether energy costs will make matters worse or provide some relief by proving stable this winter.

“With the outlook uncertain, investors will be on the look-out for evidence of companies’ ability to outperform the market decline and margin pressure. Something that isn’t easy – our recent research showed fewer than one in four companies outpace their industry peers on revenue and profit growth.

“To avoid further margin erosion from increasing costs and under-absorption, manufacturers will look for ways to adjust their pricing strategies. Many may feel the pressure to regain lost margin territory in the year ahead. Instead of differentiating based on price competitiveness, they will explore opportunities to find pockets of demand, innovate, and expand into adjacencies when appropriate.”

© OfficialAffairs