Alex Jones has given up the fight to keep control of his Infowars media empire and agreed to a quick sale of his personal and business assets.

The conspiracy theorist filed for bankruptcy in 2022 after the families of the Sandy Hook school massacre won a $1.5 billion libel judgement against him over his claim that the shooting was a 'hoax'.

He had offered the families $55 million over 10 years in settlement in a bid to retain control of his assets,but filed for Chapter 7 liquidation on Thursday after they refused.

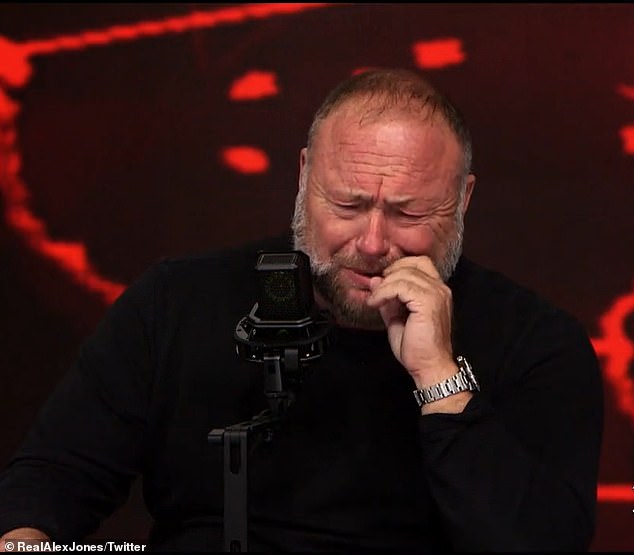

It came five days after the alt-right agitator broke down in tears during a four-hour 'emergency' Infowars broadcast,claiming federal agencies were trying to drive him out of business.

'All we're trying to do is save America,and they're f***ing us over,over and over again,' he cried.

US federal bankruptcy judge Christopher Lopez (left) will decide on June 14 how to dispose of Jones's assets, Sandy Hook attorney Chris Mattei (right) said the families welcomed Jones's latest climb-down

A court analysis found that his total assets amount to no more than $10 million,and Chapter 7 liquidation is likely to leave the families with less than $4 million between them after legal bills are paid.

But Jones's attorney told the court that Chapter 11 proceedings left them with 'no reasonable prospect of a successful reorganization'.

'Converting the case to a Chapter 7 will hasten the end of these bankruptcies and facilitate the liquidation of Jones' assets,' Sandy Hook attorney Chris Mattei told the New Haven Register.

'This is the same reason we have moved to convert his company's case to Chapter 7.'

ConnecticutAlex Jones

© OfficialAffairs